Hard Money Loans are popular among Construction, Renovation, and Real Estate Investors since those business categories require non-conventional forms of quick cash all the time. So if you are one of those industries and need a Hard Money Loan Calculator which covers all the parameters and gives you the exact value and interest of the loan, you have landed in the right place.

In this article, we will briefly discuss Hard Money Loans – what are they, who takes them, when to take Loans, and what are the positives and downsides of these loans, in a nutshell, you will get to know all about hard money loan calculators.

What are Hard Money Loans?

The word hard implies something rigid or hard cash. The literal meaning of Hard Money Loans has some controversies, but in general, these loans are those taken generally by someone in the real estate business who needs a huge amount of cash to give to the person selling the property quickly that no registered financial investment company can not or should not approve.

Sometimes the lender does not have enough credentials to get the loan approved by any bank, sometimes the conditions of the bank do not favor the lender or sometimes the processing time for the loan the bank is too long to wait for. So this loan is given by any individual or his company on a higher loan interest rate than the bank quicker than the bank, generally within 7-10 days of applying for the loan.

All Parameters for Hard Money Loan Calculator

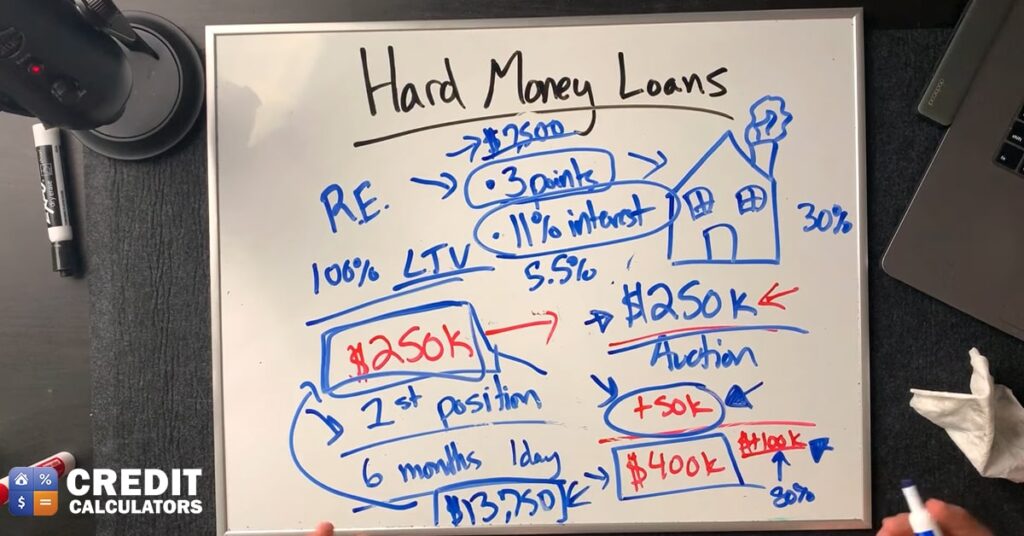

Like any bank loan, there are Capital Loan Amounts, Yearly Interest Rates, and Periods of the loan. This interest is Simple interest in nature, not compound interest. But there are many other terms for Hard Money Loan Calculator, described below :

Balloon Payment :

This means the total payment of the main loan amount and interest will be taken after a certain period, like 6-12 months. During this period, the monthly interest rate is not to be paid, but the total repayable amount is considered a balloon payment. If a hard money loan is sanctioned for 6 months by the lender, he will take the total due in 6 months and 1 day – that is called a balloon payment.

First Position :

The hard money lender will always treat the house as a mortgage and take first position, meaning if the house is sold without a fix and flipped for more or equal to the purchase value, they will get the full amount of the invested money back to them from the sold amount.

They hold title insurance, if the house is sold for more than the purchase value, any person who is in the second position of the house will take the remaining money after the first position holder takes his or her investment back.

Loan to value (LTV) :

Loan to value is the ration between the amount of loan given by the lender to the total required amount to purchase the property. In general, it is kept between 70% to 80% – which means if the purchase price of a property is $100k, the hard money loan against this given is $70k to $80k, and the rest of the purchase money is to be arranged by the receiver.

Sometimes the lender gives 100% of the Loan to house flippers with extra terms and conditions, which will add to his or her benefit, but the occurrence is rare. The total cost expense also includes repair value arv including the purchase cost.

Percentage Points :

These are the origination fees to be given to the Hard Money Loan lenders upfront for them to start the paperwork for the loan. Typically this is .3 percent of project cost but can vary from lender to lender. This amount ensures the lender that the loan applicant is serious about this purchase and he wants quick cash.

When you need Hard Money Loan Calculator

If you are in the Real Estate industry and need quick cash for flipping houses, this loan helps a lot and you can easily calculate all the parameters with Hard Money Loan Calculator. Especially when traditional financial institutes or banks deny giving real estate agents credit because of low credit scores or taking too long to process the loan, this is considered as the last resort. And a Calculator makes the process easier to keep track of.

Advantage and Cons of Hard Money Loan Calculator

The main pro of hard money loans is that you get cash quickly to purchase a property, and the main con is that you don’t own the property even after buying and later investing in repair and renovation. Only after selling the house within the stipulated time decided by the lender, you can get the profit.

Visit for Hard Money Loan Calculator.

Frequently Asked Questions :

How to calculate the payment on a hard money loan?

You can use a Hard Money Loan Calculator to calculate payment details.

What is the rate of a hard money loan?

Generally, the rate of hard money loans is 10% to 18%, it varies from vendor to vendor.

What is an example of a hard money loan?

An example of a hard money loan is a loan taken by real estate builders from nonfinancial organizations or individuals.

What are 3 points on a hard money loan?

3 Points on hard money is 0.03 percent of the total required loan amount, which is to be paid in advance to the lenders.

How Do Hard Money Loan Monthly Payments Work?

Generally hard money lenders take a balloon payment at the end of the loan period.

How Much Are Hard Money Loan Rates?

Hard Money Loan Calculators are used to calculate interest rates, they are higher interest rates, generally 10% to 18%, much more than bank charges.

Source : Hard Money Loan from Wikipedia