Over the past decade, India has witnessed a staggering surge in credit card adoption, marking a profound shift in the financial landscape of the nation. Once a rarity, credit cards have become ubiquitous, facilitating not only transactions but also fostering a culture of convenience and accessibility. However, this rapid proliferation has brought with it a host of challenges, culminating in what can be aptly described as a credit card pandemic gripping the nation.

At the forefront of this narrative is the story of individuals like Rohan (name changed), a 25-year-old caught in the throes of mounting debt and financial distress. Rohan’s journey with credit cards began innocuously, driven by the allure of zero-interest EMIs and enticing rewards offered by online shopping platforms. What commenced as a means to fulfill his aspirations swiftly transformed into a harrowing cycle of EMI payments, trapping him in a vortex of debt from which escape seems elusive.

Click here to check out Credit Calculators.

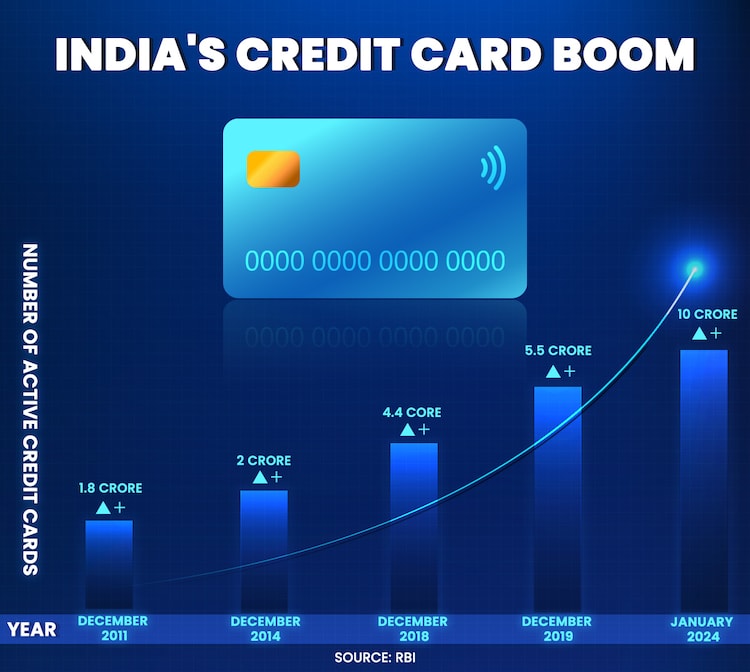

Rohan’s plight resonates with millions across the country who have succumbed to the seductive appeal of credit cards, only to find themselves ensnared in a labyrinth of financial woes. The meteoric rise in credit card issuance, from a mere two crore in 2011 to a staggering ten crore in 2024, underscores the magnitude of this phenomenon. With increased issuance comes escalated spending and, inevitably, a surge in defaults, signaling the deepening crisis confronting India’s financial landscape.

The Credit Card Boom In India

The exponential growth in credit card adoption can be attributed to a confluence of factors, chief among them being the evolving consumer behavior catalyzed by the digital revolution and the aftermath of the Covid-19 pandemic. As e-commerce gains prominence and contactless payments become the norm, credit cards emerge as not just a payment instrument but a symbol of financial empowerment. However, this newfound freedom often teeters on the brink of peril, as evidenced by the escalating defaults plaguing the nation.

Despite warnings from regulatory authorities, the allure of credit cards remains undiminished, fueled by aggressive marketing campaigns by banks and financial institutions vying for a slice of the burgeoning market. The promise of instant gratification, coupled with the convenience of deferred payments, has ensnared consumers in a vicious cycle of debt, with defaults becoming an increasingly common occurrence.

The repercussions of this credit card frenzy extend far beyond individual borrowers, permeating the fabric of the economy itself. The exponential rise in credit card spending, reaching a record high of Rs 1.72 lakh crore in October 2023, underscores the magnitude of this phenomenon. Yet, lurking beneath the veneer of prosperity lies a stark reality characterized by mounting defaults and burgeoning debt burdens, casting a shadow over India’s economic resilience.

Central to this narrative is the insidious trap of the ‘minimum due’ syndrome, a phenomenon that ensnares countless individuals in a spiral of perpetual indebtedness. Tempted by the allure of low-cost EMIs and lucrative rewards, consumers find themselves trapped in a quagmire of escalating dues and compounding interest, with each payment inching them closer to financial ruin.

The perils of the ‘minimum due’ trap are epitomized by individuals like Sohom (name changed), whose dalliance with credit cards spiraled into a nightmare of missed payments and mounting debts. Faced with the specter of defaults and incessant calls from creditors, Sohom resorted to drastic measures, opting for personal loans to extricate himself from the quagmire of debt. His story serves as a cautionary tale, highlighting the dire consequences of unchecked credit card usage.

Credit Card Defaults On The Rise In India

The symbiotic relationship between credit card issuance and personal loans underscores the precarious nature of India’s financial ecosystem. As defaults soar and lenders grapple with mounting risks, the specter of a looming crisis looms large, prompting calls for greater regulatory oversight and consumer awareness.

In the face of mounting defaults and burgeoning debt burdens, the onus lies on regulatory authorities and financial institutions to institute stringent measures to curb the proliferation of credit card defaults. Enhanced consumer education and robust regulatory frameworks are imperative to stem the tide of defaults and safeguard the financial well-being of millions.

As India navigates the treacherous waters of the credit card pandemic, the need for proactive intervention and concerted action has never been more urgent. Only through collaborative efforts and a steadfast commitment to financial prudence can we stem the tide of defaults and pave the way for a more resilient and inclusive financial future.

To read more articles, Visit Credit Calculators