Concept of Solar Tax Credit:

The Solar Tax Credit, also known as the Federal Investment Tax Credit, is a tax credit that permits individuals to deduct up to 26 percent of the cost of their solar energy system from their federal taxes. The tax credit is intended to encourage more homes to install solar, boost investment in the solar sector, and accelerate the pace of solar investment and innovation by helping to cover the cost of installing residential solar.

The solar Investment Tax Credit (ITC) is one of the most important public policy measures in the United States to stimulate the proliferation of solar energy.

Brief Concept of Federal Investment Tax Credit (ITC)

Consider the solar tax credit extension 2021 to be a federal government-backed and sponsored coupon for a 26 percent discount on your home solar installation. The ITC can significantly decrease or even abolish the taxation that you would have otherwise due to the federal government this year that you install solar.

The ITC was established by the Energy Policy Act of 2005 and was scheduled to conclude two years later, just at the conclusion of 2007. The expansion of the solar market, thanks to the ITC, contributed produce a large number of opportunities, infused huge amounts of money into the Us economy, and was such a key strategy to minimize greenhouse gases, therefore it was widely popular.

As per the Solar Energy Industries Association (SEIA), “the ITC has benefited the U.S. solar sector grow with more than 10,000% since its installation in 2006.” As a consequence, Parliament has prolonged the expiration time numerous times to keep funding expansion, and some of the most recent extensions, where it was included in the COVID relief bill and placed the termination date just at end of 2023.

Significance of Solar ITC or solar tax credit 2021

The ITC has emerged to be among the foremost influential federal policy frameworks in the United States for stimulating solar power. Solar penetration has increased fast across the country, at either the decentralized and power distribution levels. Because of the prolonged stability of this federal policy, firms have been able to continue pushing down prices. The ITC is a specific policy success story, resulting in a stronger, relatively clean industry.

To be eligible for the prolongation of the solar tax credit extension 2021, you must:

- Own the system outright or with a solar loan. Leases and PPA financing are ineligible.

- Have a tax obligation. The tax credit can be carried over and claimed in subsequent years for up to 5 years after filing.

- Purchase of original installation.

How does the federal solar tax credit work?

By now you may have understood what a solar tax credit is, now let’s discuss how the federal solar tax credit works. It will be shown by an example.

An individual may prerogative a federal solar tax credit for the money you spend on solar installation, which decreases the quantity you owe when you submit your annual income tax return. Using Tax Form 5695, you may claim the Solar Investment Tax Credit just once for the tax year where you install the system. The credit is then computed as a dollar-for-dollar decrease of your federal tax burden, so if you have 1,000 credit points, you will owe $1,000 less in taxes. Once you’ve determined how many credits you’ve gotten, you’ll want to include your sustainable energy credit card information on a standard Form 1040 when you file your taxes.

As we know, Section 25D residential ITC permits the homeowner to deduct the credit from his or her personal income tax. This credit is applied when homeowners purchase and install solar systems on their houses. The Section 48 credit is claimed by the company that installs, produces, and/or funds the project.

Click here to check out Credit Calculators.

Is the solar tax credit refundable?

The solar ITC is a nonrefundable credit; it may only be used to your organization’s federal tax liability in the United States. The solar ITC, on the other hand, can be dragged back a year forward and years for businesses that do not have enough tax burden to counterbalance for the taxable year in which the solar system was installed. Any amount of the solar ITC that’s also utilized after the 20-year carry-over period is deducted at 50%.

It is significant to mention that a tax credit is not the same as solar tax credit if I get a refund. To receive a tax incentive, you should indeed pay taxes to the federal government so that the credit can offset all or some of the sum owed. If you’ve had that taxpayer money withdrawn from your paycheck, you could get that money back as a refund, but you’re only receiving money back that you’ve already paid. If you don’t owe any taxes (for instance, if you’re retired and have no income), you won’t earn any compensation for both the tax credit since you didn’t owe any money in the first place.

Furthermore, the federal income credit for solar panels can be applied either to the federal taxes or perhaps the earned income tax credit, so you may be able to claim the amount of such federal income credit for solar irrespective of how you calculate your taxes.

How much is the solar tax credit worth?

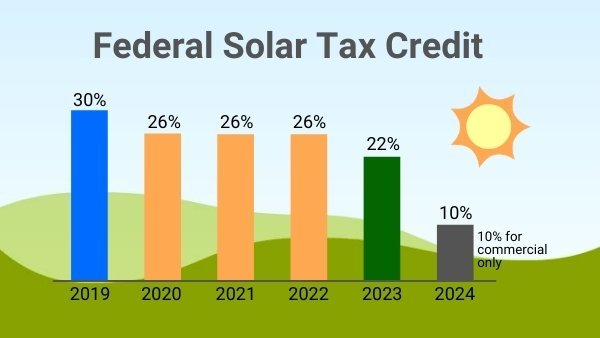

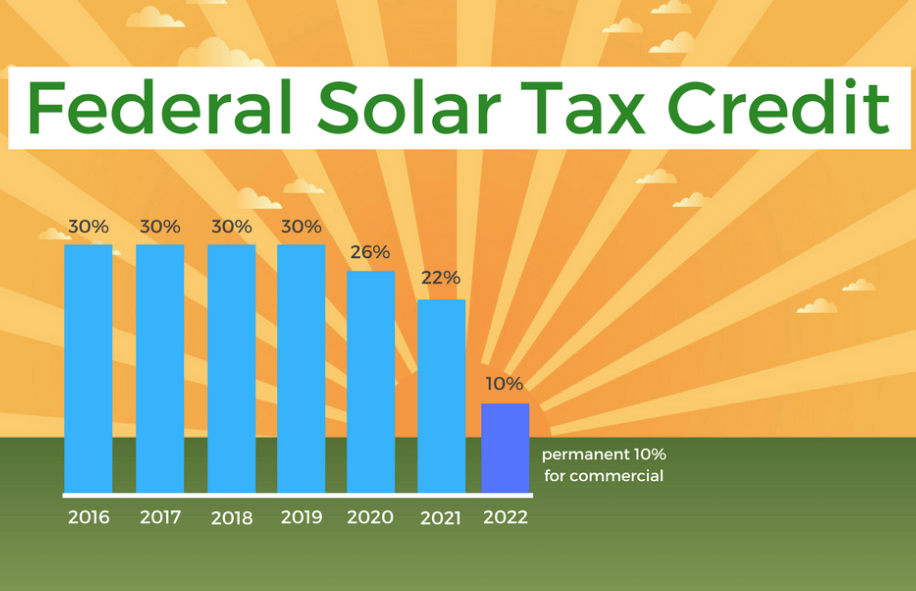

As per the recent report, the current value of Solar Investment Tax Credit is 26%. Whenever the ITC originally became available, it paid up to 30 percent of the general cost of concentrating solar panel installation. From 2006 to 2019, the 30 percent rate stayed consistent.

In 2015, Congress opted to phase away federal recent solar tax credit, commencing in 2020, whenever the tax credit for household solar power installations will be lowered from 30% to 26%. As a result of this decision, the ITC rate has been reduced from 26 percent to 22 percent in 2021.

A tax credit is a dollar-for-dollar decrease in the federal income taxes that a person or business would otherwise pay. The ITC is calculated depending on the amount invested in solar property. The residential and business ITCs are both equal to 26% of the basis invested in qualified solar property. The ITC then reduces its workload in accordance with the following schedule:

The COVID assistance bill was enacted in late 2020, and it includes a 2 different ITC extensions in federal solar tax credit 2020. The current ITC rate of 26 percent will also be applicable in 2022, before reducing to 22 percent in 2023. Beginning in 2024, the tax credit for home solar installations will be eliminated altogether, with just a limited 10% tax credit left for business solar installations.

- 26 percent – Projects that will be completed by 2022

- 22 percent – Projects that will be completed by 2023

- 0% – Projects that will be completed in 2024 or later.

There’s still the possibility that Congress reverses its mind and decided to prolong the solar tax credit again, but in the meantime, it’s nearing the end – of – life, and homes shouldn’t put off installing solar in the hopes that the solar installation federal tax credit will be extended again.

How does the solar tax credit calculator work?

The solar ITC is normally obtained by multiplying the relevant ITC percent (between 10% and 30% obviously it depends on a year construction started and whether the system was arranged in customer experience by the time limit to meet the criteria for a larger% ITC) by that of the expense of your organization’s solar energy system, which would include facilities such as:

- Solar PV panels, inverter, racking, and other system components

- Surge arrestors, step-up transformers, and circuit breakers

- Storage devices (made available that at least 75percent of the total of the source of energy comes from solar)

How can a company qualify for Solar Tax Credit?

To apply for such solar ITC, the business solar energy installation must be situated in the United States and must be:

- Depreciable or amortizable tangible assets (for U.S. federal income tax purposes). This implies that real estate and intangible assets, such as power purchase agreements, are excluded.

- New-Keep in mind that, under the 80/20 rule, an energy property could be considered new even if it incorporates used elements, as provided as that the valuation of the used components does not exceed 20% of the entire value of the energy property.

- Used by a company that is liable to federal income tax in the United States. That is, it cannot be utilised by tax-exempt groups, governmental agencies, or foreign individuals or entities.

Biden’s Solar Plans Depend on More Accessible Policy

The federal government has utilized tax policy to boost solar adoption during the previous two decades. However, it has done so by pandering to the prudence of the rich, providing solar investors with the opportunity to decrease the quantity of taxes they otherwise would incur. They do so since the tax credit provides a significant reduction on an expenditure that would both reduce their power cost and increase the value of a property.

President Joe Biden briefly mentioned the necessity of clean energy tax credits in his first State of the Union speech on March 1st, in order to cut homeowners’ energy expenses while also assisting the Biden administration in meeting its clean energy goals.

As per the statement on Biden’s solar tax credit, “Let us offer investment tax credits to weatherize your house and company to be more energy-efficient and earn a tax credit for it; quadruple America’s renewable energy output in solar, wind, and so much more.

It’s a benefit that renewable power experts think could be substantially handled by the development of a ‘direct pay’ alternative, which would put the benefits straight in the pocket of the solar user instead of as an offsetting against taxes payable the following year.

This isn’t the first occasion tax structure has been tinkered with the interest of promoting solar energy.

Solar tax credit has been around for about two decades in the United States. They were initially set up by the Energy Policy Act of 2005, which provided a 30 percent tax credit for investment in solar energy property.

Source: https://www.forbes.com/advisor/in/credit-cards/what-is-credit-card-balance-transfer/

For more info, visit here: credit calculator

One Response

I came across this wonderful site a couple days back, they produce splendid content for readers. The site owner knows how to provide value to fans. I’m pleased and hope they continue creating excellent material.