New and latest digital pay security guidelines and rules will be released by RBI ( Reserve Bank of India).

It has been confirmed by the bank. These guidelines and directions will be released at that point of time in 2020 when these digital transaction process will be at it’s peak in consideration to It’s usage and the value which is transacted in the process. It is releasing itself when the annals are covering numerous instruments and ways which includes mobile & internet banking, UPI payments, mobile wallets and also credit and debit card proceedings. RBI claims that the new rules and regulations will ensure more digital pay security to online payments.

In an official statement by RBI, it said, “Going by the pre-eminent role being played by digital payment systems in India, RBI gives highest importance to the security controls around it. Now it is proposed to issue Reserve Bank of India (Digital Payment Security Controls) Directions, 2020 for regulated entities to set up a robust governance structure for such systems and implement common minimum standards of security controls for channels like internet, mobile banking, card payments, among others,”. It also claims that the upcoming rules will be technology and platform agnostic which will have it’s motive of preparing an enhanced and appealing aura for the ones who are in usage of digital payments method with more and broadened up security.

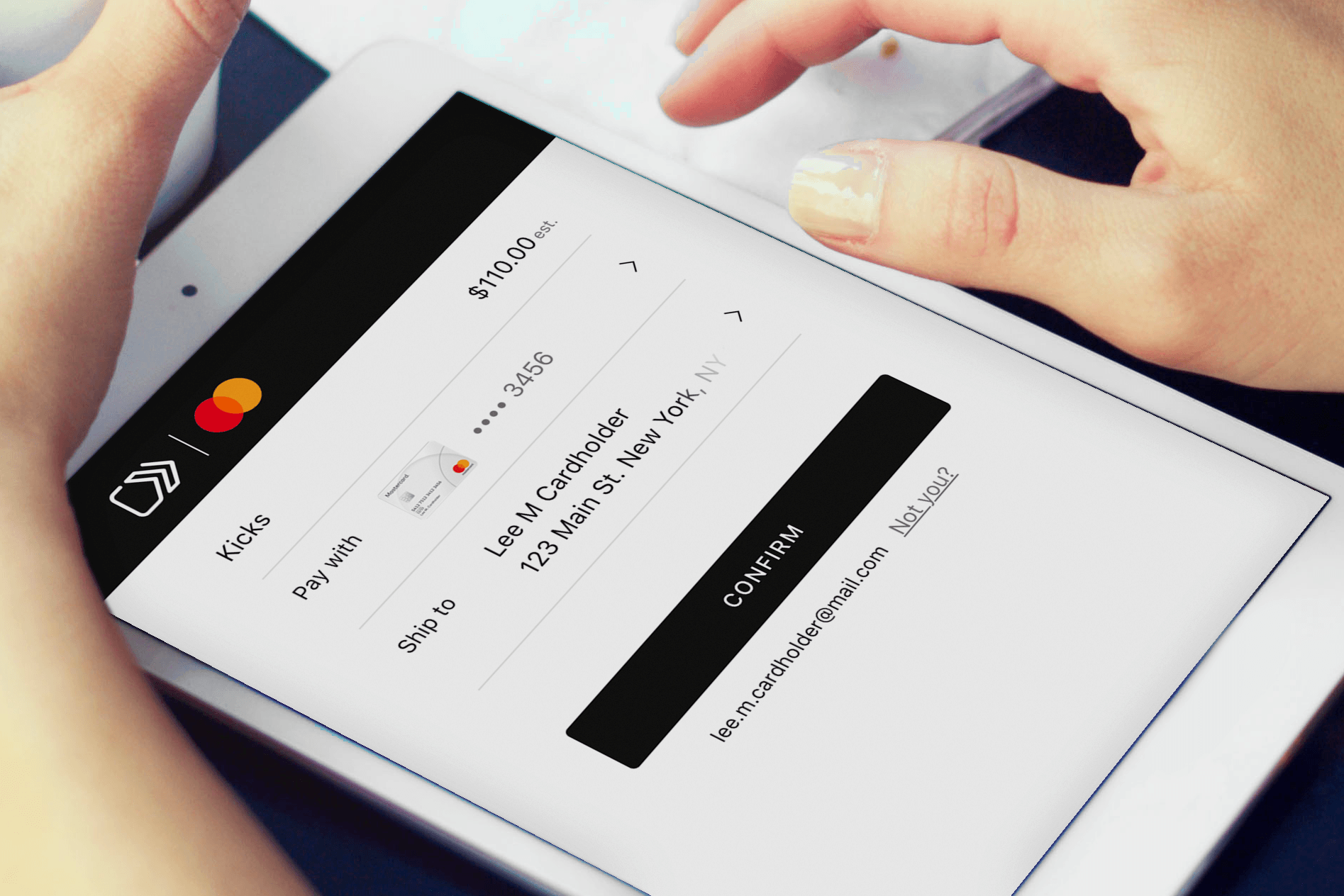

Well, there won’t be any such change on the process of dealing with the digital pay security method. The instruments and tools will be remaining similar to what it has been. The customers may carry on with the process as s/he was going on. No changes in terms of platform or applications. The cardholder using his/her card should get ensured that the bank or the provider of the card is having many options which involves the ability to start and end a transaction kind and also set certain limits for the features and transactions through that card, inclusive of transactions which go contactless.

Click here to check out Credit Calculators.

As a portion of the larger Statement on Development and Regulatory Policies, the RBI has claimed that there will remain much relaxation for the requirement of added up authentication for the credit/ debit card proceedings. The customers now have the opportunity to go contactless till Rs. 5000, which was initially Rs. 2000 for no-pin dealings. In the words of RBI, “ These are also well-suited to make payments in a safe and secure manner (means digital pay security), especially during the current pandemic. The recent instructions on disablement of contactless feature on cards and empowering customers to control the limits on their cards have also brought in added safety for users,”. These guidelines and rules will start from 1st January , 2020.

The transactions occurring via UPI (Unified Payments Interface) is consistently improving day by day. The current data by National Payments Corporation of India suggests that the transactions via UPI in November 2020 was 2.21 billion, which means it has increased by 6.7% as it was in October 2020 (2.07 billion). In the month of September, the UPI transactions were around 1.8 billion.

There has also been an increase in the credit card transactions for the last months. This was because the unforeseen pandemic has caused a wide difference in the digital space payments. In accordance to RBI verified data, the transactions were Rs. 127,129 million in the month of

April in 2020 when the lockdown took place. Well, but in September 2020 the value of transactions have increased at Rs. 291,481 million. Similar kind of growth has also been seen on the part of debit card.

In the initial days of the ongoing week, the HDFC bank was no longer allowed to issue new credit cards and no digital banking product has been launched by the bank as the digital payments through this bank viewed numerous outrages in 2020.

We are now way too much dependent on digital space to serve us multiple functions. One of them is online payment. Through this article, we have come to know, the immense growth of online banking this year. With great hope, I believe, the article has been of great use to you for digital pay security. If yes, please, for us, give your thoughtful comment in the box about digital pay security. Thank you in advance!

Source: A New Fail-proof Guidelines With Complex Digital Pay Security Issued By RBI In 2020.

Digital pay security rules by RBI