Credit Score Improvement:

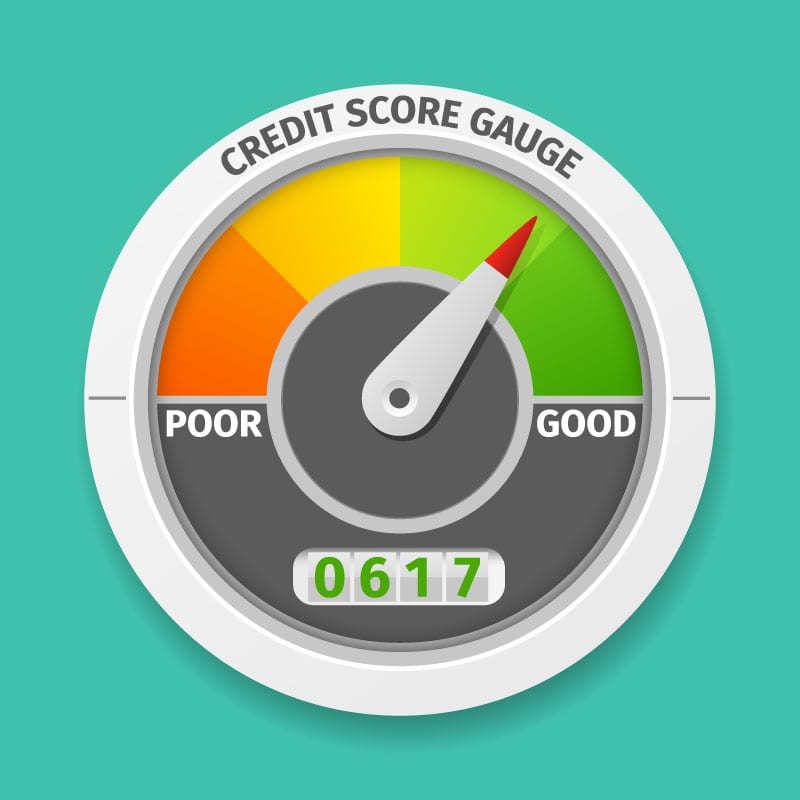

A credit score is a numerical expression that represents an individual’s creditworthiness based on a level examination of their credit files. A credit score is largely determined by a credit report, which is normally obtained from credit agencies. A credit score is a number ranging from 300 to 850 that represents a consumer’s creditworthiness. The higher the score, the more appealing a borrower seems to potential lenders.

One of the most significant qualifications you have is your credit score, which indicates to financial organizations the possibility of you repaying borrowed money.

Canadian credit scores range from 300 to 900, and if you’ve been late on payments, you may have a poor credit scoring. Some persons with no credit history may have no credit score at all.

The good news is that if you don’t have a credit history or have a poor credit score as a result of previous financial issues, you may strive to improve it.

If you want to purchase a house, a car, or take out a loan and your credit scoring is less than 600, you may find it difficult to qualify with many lenders.

“A negative credit history may also make it difficult to rent an apartment, attend college, or even find a job,” Consumer Reports’ Lisa Gill told CTV News Toronto on Wednesday.

Part of the issue is that if you want to improve your credit, you must obtain credit. So, how can you acquire credit if you have a poor credit history?

A crucial first step is to create a bank account, take out numerous modest loans, and repay them on time each month.

Click here to check out Credit Calculators.

This should increase your credit scores over time.

Following that, you might want to try applying for a secured credit card, which implies you’ve backed the card with cash. Because the payments are recorded on your credit report, secured credit cards can help you establish or rebuild your credit.

You may also ask a family member with strong credit to add you to their credit card account, but make sure you have a solid connection with that person because missing or being late with payment will harm both of your credit ratings.

Once you’ve established CIBIL scores, you’ll want to keep working to increase it. To do so, you should strive to pay off all outstanding collections, correct any mistakes in your credit history, and minimize credit card balances.

You may prevent collecting in the future if you always pay your bills on time.

“Once you pay off any debt in collections, many credit-scoring algorithms will not significantly weight it when calculating your score,” Gill added.

If you find an inaccuracy on your credit report, you may dispute it by submitting a certified letter with supporting documentation to Equifax and TransUnion.

Equifax now allows you to check your credit scoring improvement for free and access your information in a few simple steps on their website.

Also, be wary of any firm that claims to be able to improve your credit scoring quickly for a price. You don’t have to pay to enhance your credit score; it can only be done over time by developing and keeping to excellent financial practices.

For more info, visit here: credit calculator