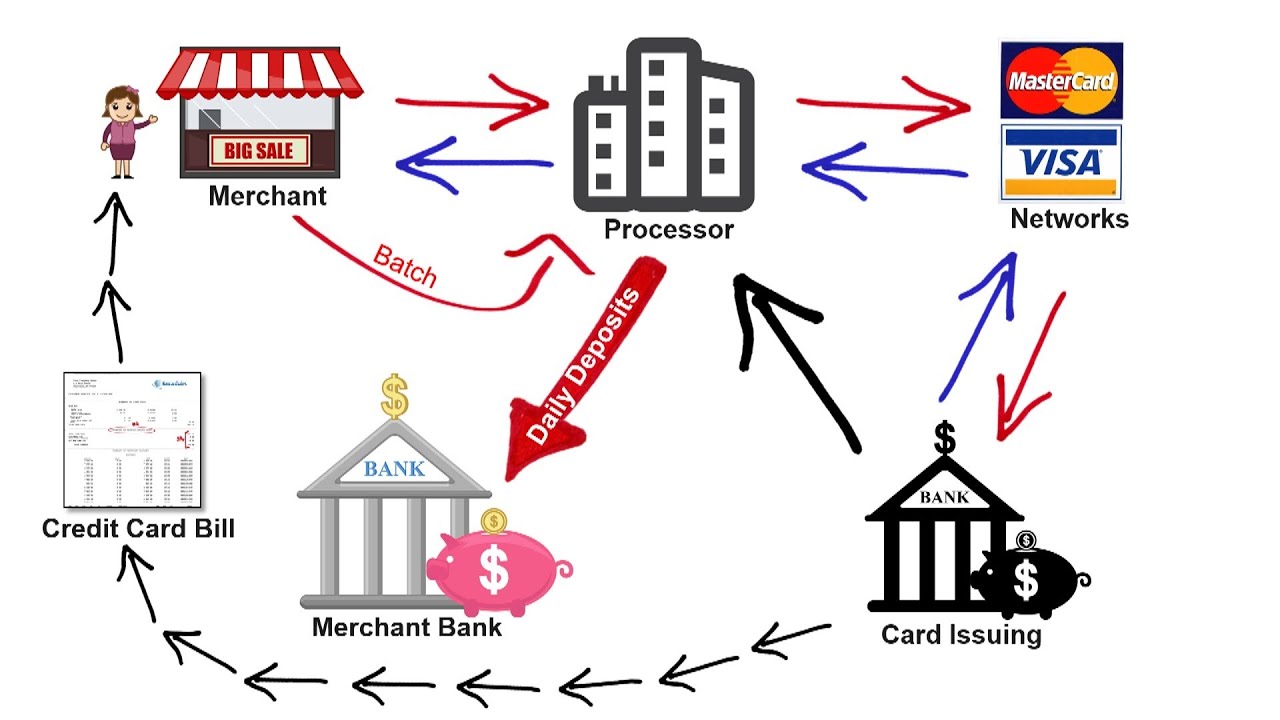

Credit Card Payment Processing

If your business accepts credit cards, you must be compliant, but you must first understand the Credit Card Payment Processing rules and who makes them.

Accepting credit cards can boost your sales significantly, whether you sell in person or online. 90 percent of e-commerce purchases are made with credit cards. Because fewer people pay with cash at businesses, using a credit card is not only more convenient, but it is frequently the only option. However, if you begin accepting credit cards, you must adhere to a number of crucial rules and laws. Here’s a rundown of those Credit Card Payment Processing rules and legislation, including how to follow them and how they’ll effect the credit card processor you choose and your operations.

PCI Data Security Standard

What is PCI DSS?

The Payment Card Industry Data Security Standard, or PCI DSS for short, is a global data security standard that all organisations that accept credit cards, regardless of size, must follow. The Payment Card Industry Data Security Standard (PCI DSS) and the Payment Application Data Security Standard (PA-DSS) are guidelines aimed at reducing credit card fraud.

The PCI Security Standards Council, an independent body founded by the four major credit card manufacturers, enforces both the PCI DSS and the PA-DSS in order to Credit Card Payment Processing.

Definition of PA-DSS?

All point-of-sale (POS) equipment and terminals must comply with the PCI DSS standards under PA-DSS. That means that if you have a POS system, your POS hardware is already taking care of the majority of your PCI compliance in order to Credit Card Payment Processing.

How to Comply with the PCI DSS ?

You must follow 12 standards to comply with the PCI DSS. The purpose of these rules is to secure cardholder data from data breaches and theft.

- To protect cardholder data, set up and maintain a firewall configuration.

- For system passwords and other security parameters, do not utilise vendor-supplied defaults.

- Safeguard the information you’ve saved.

- Encrypt cardholder data transmission via open, public networks.

- Use and update top antivirus software or apps on a frequent basis.

- Secure systems and applications should be developed and maintained.

- Access to cardholder data should be limited to those who have a business need-to-know.

- Each person who has access to the computer should be given a unique ID.

- Physical access to cardholder data should be limited.

- All access to network resources and cardholder data should be tracked and monitored.

- Security systems and processes should be tested on a regular basis in order to Credit Card Payment Processing.

- Keep an information security policy in place for all employees.

What are the four PCI compliance levels?

There are four levels of PCI compliance, each with its own validation requirements, dependent on your company’s yearly volume of credit card payments.

Click here to check out Credit Calculators.

Level 1 PCI

Businesses that perform more than 6 million credit card transactions each year are subject to this rule.

- A Qualified Security Assessor (QSA) or internal auditor must submit an annual report on compliance (ROC) every year (external or internal trained individuals certified to review payment transaction systems and assess and validate compliance)

- An Approved Scanning Vendor (ASV), a company with commercial software that analyses and performs certified vulnerability scans on business systems and networks, does a quarterly network scan.

- Form for Attestation of Compliance

Level 2 PCI

This rule applies to companies that conduct between 1 and 6 million credit card transactions each year.

- Annual self-assessment questionnaire

- Quarter network scan by an ASV

- Attestation of Compliance form

PCI Level 3

This applies to businesses that process 20,000 to 1 million credit card transactions annually.

- Annual self-assessment questionnaire

- Quarter network scan by an ASV

- Attestation of Compliance form

PCI Level 4

This applies to businesses that process up to 20,000 e-commerce payments or up to 1 million payments via other channels.

- Annual self-assessment questionnaire recommended, but not required

- Quarter network scan by an ASV, if applicable

- Compliance validation requirements set up by merchant bank

Additional credit card payment processing rules and laws

Durbin Amendment:

The Durbin Amendment was included in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which was passed by Congress in 2010. Its goal is to safeguard customers by cutting interchange costs on debit card transactions, which have the lowest risk of fraud and, therefore, should be significantly cheaper than riskier transactions, according to lawmakers. Before the Durbin Amendment, the interchange fee on a $38 debit transaction was roughly 44 cents. Debit card transaction rates were capped at 22 cents per transaction plus 0.05 percent of the purchase amount when the bill was passed. The maximum interchange cost for the identical $38 debit transaction would be roughly 24 cents in order to Credit Card Payment Processing.

However, the unintended result is that businesses with a high volume of small-dollar transactions end up paying higher costs. Prior to the Durbin Amendment, card issuers used a sliding scale to determine their interchange rate, so merchants paid reduced costs for minor purchases. They switched to charging the maximum amount on every transaction after the Durbin Amendment in order to Credit Card Payment Processing.

IRS mandate

The IRS wants to maintain track of all incoming sales, not just those paid by cash or check because business income is taxed. To that purpose, the IRS enacted Section 6050W, generally known as the IRS mandate, which requires merchant service providers to disclose to the IRS their customers’ yearly gross transactions processed with a credit or debit card or through a third-party network.

To make reporting easier, businesses must give their tax identification number to their merchant services provider. If you fail to do so, or if the IRS notifies the merchant services provider of a disparity between your reported and actual income, the merchant services provider is compelled to withhold tax on future credit card revenue in order to Credit Card Payment Processing.

Nacha

Because many online firms take direct payments in addition to credit cards, you are most likely to be affected by Nacha restrictions if you run an e-commerce shop. Any business that takes ACH payments, however, must follow these guidelines, which include the following:

- To send sensitive information, only use secure web forms and encrypted email.

- Storing sensitive client data on hard copies in a secure manner

- Validating the route numbers of consumers in order to Credit Card Payment Processing.

- Customers’ identities are verified by employing a third-party verification service

- to examine their driver’s licences, placing test amounts into their bank accounts, or forcing them to log in with a user ID and password.

Businesses that conduct 2 million or more ACH transactions yearly must encrypt payment information on their computer systems while it is at rest, according to the Nacha Supplementing Data Security Rule, which went into effect in June 2021. (not being transmitted to a financial institution). Businesses who do fewer than 2 million ACH transactions each year are exempt from the new law, but are still encouraged to comply. The rule covers both consumer and business ACH data, as well as scanned paper authorizations containing consumer payment account information in order to Credit Card Payment Processing.

Source: https://www.business.com/articles/payment-processing-laws/

For more info, visit here: credit calculator